Discover the essential Crypto Starter Guide for beginners – must-know tips for getting started with crypto and investing. An entertaining guide to boost your knowledge

Disclaimer: This blog explores cryptocurrency topics for informational and entertainment purposes. To support the site, some links may be affiliate links, meaning the author might earn a small commission if you use them. It’s crucial to remember: Always do your “own” in-depth research before investing in crypto.

Cryptocurrency for Beginners: The Ultimate Crypto Guide for Starting Out

Ready to explore the world of crypto? We get it! That’s why we created the “Ultimate Crypto Starter Guide,” a beginner-friendly guide to today’s crypto landscape. Let’s break down the basics and get you started!

1. The Safe Way vs. the Quick Path: Choose Your Crypto Journey

Start small: Have Fun Learning Crypto at Your Own Pace.

You have two options:

The Slightly Longer but Safer Route: Focus on preparation, attention to detail, and risk management. It has a bit more structure and you need to do some moderate preparation. You can do all this for zero dollars. However, if you want some of the tools of the trade then there is a small cost. A good setup can be very cheap, so don’t be conned into spending hundreds or thousands on things you don’t need.

The Quick and Easy Route: Less focus on risks. In my opinion, it is okay when starting with smaller amounts of crypto, as the risks are generally low (unless you do something careless). Get stuck in and learn by doing. Just don’t go overboard. No upfront costs are required unless you want to be prepared ahead of time while you learn the ropes. Some people get lucky and strike it rich amazingly fast. For most people, it is a long slow grind that is extremely rewarding if you know when to exit the system with your wealth intact. If you are prepared, then you have a high chance of keeping that wealth. If you are not prepared, then you could fumble and lose it all again, maybe more.

The structured way will be smoother and safer, but it takes a bit more patience and it is highly recommended you spend a small amount of money to protect yourself from unknowns. But don’t go spending a fortune

I was once like you and started on the quick and easy path. I spent no money on any of the tools, but I then started learning through doing. That learning curve cost me money and so I paid for my education the hard way. I didn’t know any better at the time so maybe you are now in the same place I was then!

Don’t spend money on anything unless you understand how it adds value. Do not follow blindly what anyone suggests.

Need it Fast? A Quick Crypto Starter Guide for Beginners.

This is a quick pick list of how I would start from scratch just to get the basics in place. Just look at the options to find the right-sized path for you. I highly recommend you read the full blog after you have your initial to-do list selected. Also, check out my other blogs as they are designed to help you on this journey to cut through the B.S.

- Choose a Crypto cold storage wallet (see a small sample list below)

- Choose a Crypto hot storage wallet (online web browser wallet).

- Get banking and money sorted.

- Get privacy and security sorted (VPNs, Antivirus etc).

- Get Tier 1 and Tier 2 Exchanges sorted.

- Learn some stuff along the way like how to use a DEX and CEX. I have written way too much below, but you should find it informative. Read over again when you get stuck on something. If that does not work and you need some help send me an email and I will help you out.

Secure Your Crypto with Cold Storage Wallets

Think of offline hardware storage as the ultimate safe for your crypto, especially if you’re serious about it. We get to the less-safe Hot wallets later so don’t stress.

My Cold Wallet Pick: I’m a Tangem wallet fan as you may have noticed through the blog post (seriously, no sponsorship yet, just love ’em!). But there’s no single “best” choice, let’s find the right fit for you. So go away and read up on what they do, then compare it to where you are in your journey, and what you need.

Old-School Paper Wallets: If you’re feeling a bit retro. This is still a valid method if you want to use them. Used primarily in the early days of Bitcoin. You can find out more about those online if you are looking and there are web apps that will help you create them.

Why Offline Wallets Rock: It’s way harder for hackers to get access to your crypto when they’re not connected to the internet!

Order a Cold Storage Wallet Before You Need It: Waiting until you’ve got a pile of crypto is risky. Get your cold wallet set up early! They don’t need to be pricey unless you want something fancy.

Crypto Keys

Private keys are the master password to your crypto stash. Guard them with your life! I will talk about this later in the blog so just know that if someone asks you for your keys then it’s most likely they are scammers, regardless of how much they act like they are trying to help you.

Think of it Like This: You have a public key like a bank account number dump money into. That’s fine to share. Then you have a super-secret private key (keep it hidden!).

Simplify Your Crypto Journey with Cold Storage Wallets Featuring Built-in Exchanges:

In the ever-evolving world of cryptocurrencies, safety and convenience are paramount. If you’re looking for a secure way to store your digital assets while enjoying the ease of buying and selling, consider using a cold storage wallet with a built-in exchange or integrated 3rd party option. These innovative devices offer the best of both worlds, providing offline storage for your cryptocurrencies and the ability to trade directly from your wallet. Just remember that this exchange feature or integration with a 3rd party normally comes with the trade-off that an exchange of currency could be more expensive than centralised exchanges. Always do your own research and test with small amounts first.

One of the significant advantages of using a cold storage wallet with an integrated exchange is the enhanced security it offers. By keeping your digital assets offline, you minimize the risk of falling victim to online threats such as hacking attempts or phishing scams. This added layer of protection ensures that your cryptocurrencies remain safe and secure.

Some (not all) of these cutting-edge cold storage wallets now support the exchange of coins or access to Fiat via direct Visa payments, making it even more convenient to purchase cryptocurrencies. You may no longer need to navigate the complex traditional exchanges or worry about the potential risks associated with them. I think this is an option that is growing with third-party integration into your cold storage wallet where you can swap or buy your desired cryptocurrencies using your Visa card (or other), streamlining the entire process. Keep an eye out for more of these integrations into a wider variety of wallets.

To help you get started, I have selected a small list of the top crypto cold storage devices. By choosing one of these wallets, you can start your crypto journey with confidence, knowing that your assets are secure and easily accessible. The security is high but the range of crypto capability and ease of use will determine your sweet spot relative to the cost of the investment. Remember that flashy and expensive does not always mean it’s the best or safest. An example is the Onekey Touch Classic. The new pro version is a great device but the older simple Classic version does almost the same excellent job at a fraction of the cost. The Tangem looks simple but is packed with features at a low price which makes it my current favourite. The Trezor and Ellipal Titan go hard on security but get a bit more complex.

Unlock Exclusive Discounts on Genuine Cold Storage Wallets. We’ve partnered with trusted suppliers to bring you exclusive discounts on the best cold storage wallets. By using our affiliate links, you’ll access special promotions and deals, ensuring you get the most value for your money. These links direct you to the official websites of manufacturers and authorized retailers, guaranteeing product authenticity.

Important: Always prioritize security by purchasing cold storage wallets directly from the manufacturer or authorized retailers. Avoid using second-hand or pre-owned wallets, as their security cannot be guaranteed.

Our Comprehensive Rating System: Our ratings are based on personal experience, user feedback from platforms like Reddit and Google, and advanced AI algorithms that process and interpret user feedback data. This approach provides a well-rounded and unbiased evaluation of the top cold storage wallets available.

- Ledger devices

- Ledger Nano X

- Versatile, Bluetooth, user-friendly, supports 5500+ coins

| Option 1: Ledger devices The Nano X used to be listed @ USD 119 when I wrote this blog, please check the price now. I purchased the Nano S (Non-Bluetooth). I wish I had the Nano X version for Bluetooth convenience to use with a cell phone, but the cost put me off. I use it to secure my hot wallets like MetaMask and increase their safety because the MetaMask in combination with a ledger creates a secure semi-cold storage option. However, the ledger can work just as well if not better on its own. I share the distribution of my funds between various cold storage options. Although I still have funds on my ledger, I am not using it as much these days as other options are more convenient and versatile but that is not to say it’s a bad device. There is concern from crypto enthusiasts that the Ledger manufacturer can now bypass security and therefore the perception is this feature risks invalidating the security. It was a huge marketing blunder when they tried to introduce the new feature as a lot of trust was lost. It is still a good device and do not find it to be a problem but have a read of the various articles online so you are aware of the events. Ledger also has some good integration tools that do a lot of other cool stuff around trade, swaps, pools etc. If you are interested, then have a look at what they can do. Security: Historical a strong security track record, secure element chip, PIN protection. The Nano X Bluetooth adds a small potential attack vector, but I still use it and have no issues. A few years back they had a hack in their user database holding people’s addresses. This exposed a lot of users to fishing attacks costing users about half a million dollars based on what I read. Ease of Use: User-friendly interface, good balance of features and simplicity. Trust: Well-established brand, generally trusted by the crypto community until recent update options regarding password security caused some concern. Rating: 8.5/10 – As a user of Ledger I am happy with it but I suspect public opinion is now trending downwards due to the poor PR over the new “recovery option” additional feature. and the fact they had a hack in their user data which exposed a lot of users to fishing attacks costing users about half a million dollars. Don’t let that put you off. |

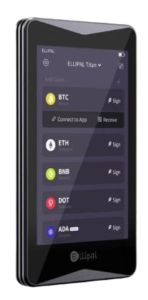

- Ellipal Titan

- Completely air-gapped, touchscreen, supports 10,000+ coins.

- Uses QR codes

| Option 2: Ellipal Titan – I like the price and the fact it is fully air-gapped. Ellipal Titan Completely air-gapped, touchscreen, supports 10,000+ coins. Uses QR codes. $169 USD last time I checked but go to the link button above for the official website and pricing – I’ve never tried this unit personally but hope to in the future. I went looking for good quality cold storage options. I put this in because the user reviews are good, and I wanted to provide you with some comparable options. Security: Extreme air-gapping is the primary focus, anti-tamper design. Closed-source firmware is a debate point because purist Crypto enthusiasts prefer open-source code. Ease of Use: Simple for beginners. A comment online is the QR code method may feel slower to some. Trust: Good reputation. Rating: 7.5/10 Pro Tip: Buy the bundle or get the “ELLIPAL Seed Phrase Steel” separately |

- Trezor Model T

- Touchscreen, advanced features, supports 1800+ coins

| Option 3: Trezor Devices Trezor Model T Touchscreen, advanced features, supports 1800+ coins $179 USD was the price last time I looked but please visit the website to check pricing and models now available I’ve not tried this device personally, but it is very highly regarded by the crypto community. It is very popular and the user reviews are good to excellent. It does not do the range of Crypto that I want but it is a high-quality device Security: Excellent track record, touchscreen offers some advantages, supports advanced features like Shamir Backup. Ease of Use: The touch screen is convenient, but the interface can be a bit more complex for beginners. Trust: Long-standing brand, highly respected in the community. Rating: 8/10 |

- Tangem Wallet (3 Pack) Card-shaped NFC

- Extremely easy to use

- Supports 600+ coins & over 30 blockchains

- OneKey

- Model- OneKey Touch

Open-source, air-gapped, large touchscreen, Bluetooth (with safeguards)

| Option 5: OneKey Touch – Possibly My Next Purchase? Varies by model- OneKey Touch is $249 USD – Please check the website for pricing. Varies by model- OneKey Pro is $278 USD – Please check the website for pricing. Open-source, air-gapped, large touchscreen, Bluetooth (with safeguards). Security: Open-source firmware (promotes transparency). Secure element chips (protects keys). Air-gapped design (most models). Bluetooth on some models (potential trade-off). Ease of Use: User-friendly setup and interface. The model variety caters to different skill levels. Touchscreens on some models improve usability. Trust: Gaining a reputation in the space. The open-source approach builds trust. Appeals to a diverse user base. Rating: 7.5/10. My general feedback from users is that it’s a great device but the top model is priced accordingly. I hear a lot of people are exceptionally impressed by the “Touch” model for price and functionality, and its onboard Exchange capability which is becoming more common in the market. I am guessing the new ONEKEY PRO model has yet to get enough feedback as most people already like the Touch and cannot afford both. Pro Tip: The Classic is excellent and can do most things but is less flashy and less expensive. Pair this with a steel wallet of some sort to keep your seed phrase safe just like all the other options. |

Fund Your Crypto Adventure: How to Get Started

Buy Crypto the Simple Way

The simple way: Log into a crypto exchange that accepts credit or debit cards, and directly buy crypto. However, you run the risk of your bank thinking it’s fraud and putting a freeze on your account and credit cards. That’s very inconvenient if you need to use that account for everyday banking. I had to learn the hard way. I recommend you do some preparation and get this part sorted.

Don’t forget you can now use many of the Cold Storage Wallets that have built-in Exchanges. They can often access Visa to purchase crypto and you never have to go near any exchanges. See the list of crypto cold storage devices above.

Set Up Secure Crypto Banking

My preferred way is to set up a free debit card to isolate your crypto finances from your normal banking. This approach is safer and easier to manage (despite some extra visa card fees). In this separate account, you may also want to open a new bank account so you can do direct transfers and take other security measures – it’s up to you as it is country-specific. I did not want any hassles and I explained more about my banking method further down.

Build Your Crypto Savings and Investment Strategy:

Free Debit Card Hunt: My goal was no fees and no connection to my main bank. This keeps my crypto world apart from my normal banking, and it’s super convenient for tiny amounts. Big-money folks should get a proper commercial account! These types of accounts are only an intermediary for temporary money storage and money transfer from your normal banking world into the crypto world.

Separate App, Separate Mindset: I installed the bank’s app on a different device than my usual banking. This helps create mental and physical separation. When I say separate, I mean I used a totally different bank from your personal or business bank. Where I am in the world you should consider total separation, so your normal banking system does not try to freeze your account by accident.

Heads-Up to the Bank: I called and told them I’d be using my new debit card account only for crypto. This way, they won’t freeze it due to strange transactions (yep, that happened before!). I made sure I stipulated No Overdraft was allowed either. A piece of advice. Never go into debt with crypto as that is a fool’s game.

I had a fun chat with the bank Risk team who had no clue about crypto but kept telling me it was terrible but did not know why when I kept asking about it. They thought the bogeyman was coming to steal all the money. The script they read to me missed that part about reasoning. If you call the bank like I did please make sure you tell them how you will use that account, so they are not confused. I did not want them to freeze the account anymore, and to their credit, my account has been working very well since that discussion

Shoutout to My Bank: I use Westpac in New Zealand for this. Find your own country’s equivalent! (Let me know good options, and I’ll add them to a future list to help others). For me, I just set up a free debit visa card, everything is online using an app to reduce any costs and so I can track banking transactions.

My Crypto Savings & Investment Plan

My personal strategy has been to send a small, automated amount from my main bank to this specially isolated account, weekly. It’s like a fun investment or a better Lotto ticket! It helps me learn and earn crypto without losing my shirt by overcommitting. Remember: Crypto is WILD. Don’t spend what you can’t afford to lose and if there is profit then get used to taking it out regularly until you have got back your initial investment. The rest is then playing money.

Do not store your money with intermediaries and exchanges unless you understand the risks. Learn to self-custody for at least 95% of your funds. Only go onto exchanges for trading then get the money off again. That’s how I normally do it. Sometimes I use DEXs if I want access to something in particular, however, they may cost a bit more compared to a CEX like MEXC. The whole idea of the crypto endgame is not just to make or lose a ton of money. It’s to give yourself an alternative to the banking system and the bloodsucking irreverent way many of them act. Go research the history of why Bitcoin was made after the financial crisis of 2008.

To round off this section my strategy is to be repeating from Crypto about 550 days after the Bitcoin halving. Sooner if the international financial system goes bankrupt in the USA. I guess that after the elections there is no need to pretend the economy is still healthy. That will pump money into the economy and could drive Crypto to insane heights when governments print money, but at some point, everything is going to start crashing down.

Link Bank Accounts for Easy Crypto Purchases

Prioritize Security: Always go with reputable exchanges. Check their history and how seriously they take protecting user funds.

How to Link:

- ACH Transfer: A reliable, often cheaper option. Think of it as the “slow and steady” way to move money.

- Wire Transfer: Faster transfers for those big purchases but be aware of potentially higher fees.

Debit/Credit Cards vs. Bank Transfers: Which Fits Your Needs?

Cards:

- Pros: Instant crypto! May also offer rewards points, depending on your card.

- Cons: Fees from both the card issuer and the exchange add up. Some banks frown on crypto, too.

Bank Transfers:

- Pros: Often lower fees, especially for larger purchases.

- Cons: Can be a bit slow – not ideal when crypto prices are swinging wildly.

Third-Party Payment Gateways: The Familiar Faces

- PayPal, Venmo & Co.: These services offer a user-friendly way to dip your toes into crypto.

- Pros: Convenient if you’re already using them. May have some buyer protection in place.

- Cons: Limited coin selection. Fee structures can still be a bit murky, and sometimes you can’t withdraw your crypto off the platform.

Bottom Line: There’s no single “best” way! It depends on whether you prioritize speed, lower fees, or convenience. Remember, security is always important, so use reputable platforms and protect your passwords and keys.

2. Protect Your Crypto: Prevent SIM Swaps & Phone Hacks

Let’s dive into phone security. Skip this section if keeping your money safe is not a concern.

What is SIM Swapping? Keeping Your Crypto Safe

Beware of SIM swapping: This is a sneaky social engineering trick where they convince someone to swap your SIM data onto a new phone card that a hacker controls. To protect yourself do the following to slow them down or stop them:

Contact your phone company: Emphasize your security needs and request that they only authorise the replacement of your SIM if you are physically present with suitable authorisation like a passport or similar identification with an authentic profile picture. This will help save you against identity theft if they steal your SIM card (using SIM card swapping) which gives them access to your phone contents.

SIM swapping is a concerning security issue that can lead to unauthorized access to your accounts. Here are some extra steps you can take to protect yourself from SIM-swap attacks:

Enable SIM Card Lock:

- On Android:

- Launch the Settings app.

- Scroll down and select Security & Privacy.

- Choose More Security Settings near the bottom of the page.

- Tap the SIM card lock and flip on the Lock SIM card toggle.

- On iPhone:

- Open the Settings app.

- Tap your Apple ID at the top.

- Scroll down and select Password & Security.

- Enable SIM PIN and set a PIN code

- Use App-Based Authentication:

- Instead of relying solely on SMS-based two-factor authentication (2FA), consider using app-based authentication programs like Google Authenticator. These generate one-time passwords (OTPs) that are more secure than SMS messages.

Be Wary of Phishing Attempts:

- Avoid clicking on suspicious links or providing sensitive information over the phone. Scammers may try to trick you into revealing details needed for a SIM swap

Add a VPN to your phone: It’ll mask your ID and secure your internet connection. My NordVPN allows me to use my licence across several phones and devices.

Browse Securely with Crypto

As I said above, make sure you have Enabled two-factor authentication (2FA) whenever possible. When 2FA is enabled don’t use Text as a form of authentication. Use a 2FA app that provides new codes all the time (Microsoft or Google have these apps). Or… use an encrypted and password-protected email service.

Password Power: Using the same, weak password for every site is like leaving your front door wide open. Make each password long, complicated, and unique – like a different, super-secure key for each online house you own. A password manager app can help you remember all those crazy passwords

I don’t currently use a password manager, yet. I was doing this research and thought maybe I should put it on my to-do list. I have a method for remembering passwords, but it is getting more difficult by the day. Maybe it is about time to pick one from the list below.

Depending on your situation, password managers are often essential for securely managing your online credentials. Here are some reputable options that prioritize security and have not been involved in significant security breaches:

Password Manager Programs

Smart Crypto Browsing: Passwords, Best Practices

Password Power: Using the same, weak password for every site is like leaving your front door wide open. Make each password long, complicated, and unique – like a different, super-secure key for each online house you own. A password manager app can help you remember all those crazy passwords, but you may want to simply keep those passwords off the net and write them in a notebook. Please don’t take a picture of your passwords and leave them on your phone in case those pictures get hacked.

I do have friends who have used an old camera phone that will never be connected to the internet again (or Bluetooth or Wifi) and they use that as a memory backup. They don’t keep it charged or anything and it is still password protected so I guess it could work as long as the kids don’t try to reconnect it to the internet (or Bluetooth) to play games. I would not do it although it sounds ok. It is about understanding the risks of losing passwords compared to getting hacked or someone reading your diary with all your passwords in it. Maybe you are just better off using one of the options below.

1Password:

Known for its polished apps, 1Password offers robust features, compatibility, and ease of use. It uses strong encryption and provides clear security recommendations. While it’s a paid service (approximately $36 per year), it’s worth the investment in theory.

Bitwarden:

If you prefer free software, Bitwarden is an excellent choice. It covers all the basics of a good password manager and doesn’t cost anything. For additional features like password checkups and encrypted storage, consider their reasonably priced premium plan.

Dashlane:

Reliable and user-friendly, Dashlane is another solid option. It offers features like password change reminders and secure password evaluation.

KeePass:

Ideal for programmers, KeePass is an open-source password manager that allows you to manage your passwords locally. It’s highly customizable and doesn’t rely on cloud services. Yes it is FREE. Be mindful it is potentialy less user friendly but highly functional.

Keeper:

If scalability is important, Keeper provides secure password management for individuals and businesses. It offers features like secure file storage and sharing.

LastPass:

Tired of remembering complex passwords? Simplify your online life and boost your security with LastPass! It makes managing passwords effortless and it’s even free to try. Get started today.

Remember that no system is completely immune to risks, but using a reputable password manager significantly enhances your security. Always choose a strong master password and consider enabling multi-factor authentication (MFA) for an extra layer of protection. Please check the websites for more detailed information.

Public Wi-Fi Risks: What Not to Do with Crypto

Don’t use public Wi-Fi for sensitive activities like using Crypto wallets or Banking: Turn off Wi-Fi on your phone when using banking or crypto apps in public places. If you really must take the risk and don’t have enough data, then make sure your phone VPN is active. Even then, be cautious! Many good crypto people and phone banking users have lost money when they use public Wi-Fi. Public data means someone else can access all your free data.

Mac book security alert | WIFI and Crypto or Banking

Attention crypto enthusiasts! If you’re using a recent Apple MacBook Pro with an M1, M2, or M3 chip (essentially any model released in the last five years), be cautious when accessing your crypto applications on public Wi-Fi networks. A potential security vulnerability has been discovered, stemming from hard-wired issues within these chips.

This flaw could expose your device to hackers, putting your crypto assets and personal information at risk. To protect yourself and your investments, it’s strongly advised to avoid using these MacBook models for any crypto-related activities while connected to public Wi-Fi.

If you’re concerned about this issue and want to learn more, several reputable websites have covered this topic in-depth. For example, [insert 2-3 relevant and trustworthy websites here] provide detailed information on the potential risks and steps you can take to secure your device.

Remember, staying informed and vigilant is crucial in the world of cryptocurrency. Always prioritize the security of your assets and personal data, especially when using public networks. If you own an affected MacBook Pro model, consider using alternative devices for your crypto needs until a solution is available.

Stay safe out there, fellow crypto enthusiasts!

- M1 Mac and newer models have an unpatchable vulnerability (msn.com)

- There’s a vulnerability in Apple’s Mac chips–and the fix might be as bad as the flaw (msn.com)

VPN Basics for Crypto and Online Banking

My history with computer security was always good. Now that I have more to lose, I have made sure it’s even better. I prioritize security to avoid viruses and hacks and losing my personal information.

In the last few years, I started using a VPN for network data protection, especially now that I’m handling more crypto. Even if you don’t currently use one, it’s worth considering. I use Nord VPN and have done it for a few years because it’s cheap, easy and secure, but there are other reputable options that I have researched and listed below if you are interested in choosing something that better suits your needs.

VPN benefits: It masks your information and location, adds a layer of security, and can potentially help you access exchanges that might be restricted in your country. Be cautious about the last point, as there are often moderate to high risks involved if you are trying to be evasive. That should not stop you from investigating and managing those risks.

Optional: VPN network protection. Just pick one of them if you are going to install a VPN.

Check pricing in your country. There are often large discounts for 12- or 24-month or 24-month plans.

NordVPN:

- Pricing: NordVPN offers different subscription plans, including monthly, yearly, and multi-year options. The monthly plan costs around $11.95, while the annual plan is approximately $83.88 (billed annually). They often run promotions, so check their website for the latest deals.

- This is the one I use across all my devices but look around to find one that suits you

- NordVPN is an excellent choice for premium VPN services. It offers robust security features, a large server network, and reliable performance. With NordVPN, you can enjoy strong encryption, a no-logs policy, and the ability to bypass geo-restrictions. It’s a top pick for privacy-conscious users.

ExpressVPN:

- Pricing: ExpressVPN is slightly more expensive but offers excellent performance. Their monthly plan is around $12.95, and the annual plan costs approximately $99.95 (billed annually). They also have a 30-day money-back guarantee. Check their website for current details.

- ExpressVPN provides a fantastic user experience with fast speeds and various server locations. It’s ideal for global location spoofing and streaming content from different regions. ExpressVPN also prioritizes privacy and security, making it a solid choice.

SurfShark:

- Pricing: Surfshark is budget-friendly. Their monthly plan is about $12.95, but the real value lies in their 2-year plan, which costs only $47.76 (billed every 24 months). It covers unlimited devices, making it an attractive option for families or multiple devices. Check their website for current pricing.

- Surfshark is an affordable VPN option that doesn’t compromise on security. It’s great for protecting multiple devices simultaneously. Surfshark offers features like ad-blocking, malware protection, and a strict no-logs policy. If you’re looking for a budget-friendly VPN, Surfshark is worth considering.

3. Get Started with Crypto: Essential Knowledge

Trading, Taxes, Tools, and Staying Safe

Crypto and the Law: What You Need to Know

Know Your Region and Crypto Legal Obligations. They will vary country by country, so always check what’s legal (and what’s not) before diving in. Stick to the basics when starting out, and don’t do anything that could land you in hot water. It’s just not worth it. If you’re unsure, then drop me a line and I will do some checking specific to your region and hopefully point you in the right direction so you can do your research.

Crypto Taxes Made Simple: Avoid Confusion

Depending on the country, the gains you make in Crypto could be classified as capital gains and you may need to pay tax on them (like in the USA). The rules around gains tax, losses and holding periods can be complicated and very dependent on your location. You may also need to track all crypto and provide evidence of activity. If unsure, get professional advice. I might know a useful resource to help if you want to reach out to me but remember, Titans Reserve is not a financial advisor.

Navigating the complex waters of crypto taxation can be quite an adventure! While many countries have established clear guidelines, some make it more challenging for crypto enthusiasts. Let’s explore both ends of the spectrum:

Countries with More Favorable Crypto Taxation:

I listen to many crypto influencers who have escaped to different countries to be in the sun, sand and beaches, well away from crypto taxes and laws that affect their incomes. The ones below are not indicative of the sandy beaches but instead, look at stock standard places around the world where people live their day-to-day lives rather than a fairytale story of rags to riches living on a beach. But wouldn’t that be awesome?

- Germany:

- Germany has some intriguing crypto tax rules. While crypto isn’t entirely tax-free, there’s a quirky twist. If you hold your crypto for over a year, any subsequent sale, swap, or spending of it is tax-free. However, if you sell within a year, you’ll be taxed unless the profit is less than €600.

- Belarus:

- In this Eastern European state, crypto activities are considered personal investments. As a result, they are exempt from both Income Tax and Capital Gains Tax until January 2025. Belarus took a unique approach by legalizing crypto activities without imposing specific tax laws.

- El Salvador:

- El Salvador made history by adopting Bitcoin as legal tender. Foreign investors are exempt from Capital Gains Tax on Bitcoin profits. Additionally, businesses in El Salvador must accept Bitcoin as payment, creating a crypto-friendly ecosystem.

Countries with More Challenging Crypto Taxation:

- Denmark:

- Unlike many other countries, Denmark taxes all cryptocurrency profits as income tax rather than capital gains. So, if you’re in Denmark, crypto gains are treated like regular income.

- Sweden:

- Swedish tax authorities classify all crypto assets as “other assets.” While this doesn’t mean they’re tax-free, it’s essential to understand their unique categorization.

- The Netherlands:

- The Netherlands stands out by taxing unrealized cryptocurrency gains. If you’re holding crypto, even if you haven’t sold it, you might still face tax implications.

- France:Coin

- France has stringent crypto tax regulations, including capital gains tax on crypto transactions. It’s essential to stay informed about their evolving policies.

- Japan:

- Japan has a comprehensive regulatory framework for cryptocurrencies. While it’s not necessarily difficult, it’s essential to comply with their rules, including reporting and taxation

- Australia:

- In Australia, cryptocurrencies are considered assets rather than currency. The Australian Taxation Office (ATO) views them as subject to Capital Gains Tax (CGT). If you sell or exchange crypto, it triggers a CGT event, and you must report the gains. Even activities like using Bitcoin to purchase Ethereum are considered capital events for tax purposes.

- Starting from the 2022-23 financial year, the ATO introduced a dedicated section called Schedule – Virtual Digital Assets (VDA) for reporting crypto gains and other virtual digital assets (VDAs) on your tax return.

- Canada:

- In Canada, cryptocurrencies are treated as property for tax purposes. Capital gains tax applies to crypto transactions. If you sell or trade crypto, you’ll pay income tax on half of the gains. Additionally, there’s a 1% Tax Deducted at Source (TDS) on crypto transactions exceeding certain thresholds.

- United States:

- Cryptocurrencies in the U.S. are considered property as well. Capital gains tax applies to various crypto-related events, including selling for fiat, gifting, purchasing goods, and trading one digital asset for another. Income tax events include receiving crypto from airdrops, interest earnings, mining, and payments for work. However, some aspects, like staking rewards, remain less clear.

- India:

- India treats cryptocurrencies as virtual digital assets (VDAs). Capital gains tax applies to gains from crypto trading, and income tax events include crypto interest earnings, mining income, and payments received for work. The government introduced a flat 30% tax on crypto transfers, and 1% TDS on sell transactions starting in 2022.

- South Korea:

- South Korea is actively addressing crypto tax evasion. They plan to launch a virtual asset tax system by 2025. The new system aims to ensure transparency and compliance. Previously, they imposed a 20% income tax on crypto transactions and introduced a 1% TDS on sell transactions.

- China:

- China has a complex relationship with cryptocurrencies. While they banned crypto exchanges and initial coin offerings (ICOs), individuals still hold crypto assets. However, specific tax regulations are not well-defined, and the situation remains fluid.

- New Zealand,

- The taxation of cryptocurrencies is an interesting blend of clarity and flexibility. The Inland Revenue Department (IRD) in New Zealand does not consider cryptocurrency as money. Instead, it is viewed as property for tax purposes. While there are no specific crypto-specific tax laws, new legislation is currently before Parliament to clarify the GST treatment of “crypto assets” and address timing issues. Crypto in New Zealand is subject to Income Tax. The tax rate depends on your total annual income. It can range from 10.5% to 39%23. If you engage in activities like mining, staking, selling, or trading cryptocurrency, you’ll need to report your income and pay taxes based on your income tax bracket. Stolen Crypto assets: If you held crypto assets that were stolen, you may be able to claim a deduction for the loss. GST (Goods and Services Tax): The new legislation aims to clarify the GST treatment of crypto assets. However, until that is finalized, it’s essential to stay informed about any updates.

Consider setting up a way to track all your transactions. I have added some application links I hope will help if you’re in one of these highly taxed countries. These are just a few of many that will develop over the coming years.

Important Note: These applications connect to your exchange and wallet data to calculate taxes. Always double-check their calculations with your records and consult a tax professional for complex situations.

Additional Considerations:

- Look for features that suit your specific needs (e.g., NFT support, DeFi tracking).

- Explore free trial options before committing to a paid plan.

- Security is paramount – ensure the application uses secure data storage practices.

Application 1: CoinTracker

- Pros:

- The free tier covers basic needs.

- Integrates with many exchanges and wallets.

- Supports automatic trade syncing.

- Generates tax reports (paid plan).

- Cons:

- Free tier limitations (e.g., limited number of transactions).

- Paid plans can get expensive for complex portfolios.

Application 2: Koinly

- Pros:

- User-friendly interface.

- Supports many exchanges and wallets (automatic or manual import).

- Generates various tax reports (paid plan).

- Offers tax optimization features (paid plan).

- Cons:

- Free tier limitations (e.g., limited number of transactions).

- Paid plans can be pricey for advanced features.

Hot Wallets: Manage Your Crypto Daily

Security first: Lots of people lose money with hot wallets because they can be easily hacked. They are normaly only extensions to your web browser and most people don’t practise safe handling of the wallets. Even when they are doing all the right things people can still get hacked. Hot wallets need attention! Strong passwords, 2FA whenever possible, and stick to trustworthy providers. I cannot stress enough to store larger sums of money in cold storage wallets

Your crypto needs matter: What coins do you want to hold? Do you need fancy features in a wallet that may help you decide what type of hot wallets suit you best or maybe you’re still better off with cold wallet storage? Keep those in mind as we go. Also, remember that exchanges have their own versions of wallets. The difference is they act like a bank, and they hold your funds. They promise to give them back to you but cannot guarantee it. Hot and cold wallets act independently, and the money is in your custody. This also means that if you don’t remember the passwords then you lose access to your funds, and nobody will be able to retrieve them for you.

This is only a list of a few hot wallets. I have used MetaMask a lot in the past and it has developed a lot of new features. For a while, I used Ledger as an extra security hardware layer. These days I don’t use MetaMask as much now that I have my cold storage Tangem wallet.

Important Considerations:

- Security: Always prioritize security practices even with hot wallets (strong passwords, 2FA, reputable providers).

- Your Needs: Consider which blockchains and features are most important to you.

- Research: Always do your own research before choosing any wallet!

- MetaMask:

- One of the most popular Ethereum-focused wallets.

- Browser extension and mobile app for easy access.

- Supports a wide range of Ethereum-based tokens (ERC-20).

- Coinbase Wallet:

- Directly connected to the Coinbase exchange for seamless interaction.

- Supports a vast array of cryptocurrencies across multiple blockchains.

- User-friendly interface designed with beginners in mind.

- Trust Wallet:

- Mobile-centric wallet with multi-chain support.

- Simple interface, good for on-the-go crypto management.

- Integration with Binance and offers staking features.

Top Crypto Tracking Apps for Beginners

Unlike the apps for TAX above this section, the next are simply free ways to track your crypto and help you find the right crypto reliably. Download these two apps to your phone and bookmark them on your computer browser. Use these as key references for crypto names and addresses. They are the most reliable source of information you will find as it’s easy to type in the wrong thing and latch onto the wrong website. Don’t use random links you see on Google search results because some of those paid website links will take you to fake websites that steal your information. If you must go to the link, then type it in yourself if you want to be safe.

Why you need these (CoinGecko and CoinMarketCap): Think of them as your crypto HQ! Most people use these apps to set up lists of all the coins they own, even if they’re stored in different wallets. That way, you can see how much everything is worth (in your local currency!) in one place and as they fluctuate. As you get deeper into crypto, these apps are also great for researching new coins and creating watchlists for tokens you’re interested in. It’s a fun way to keep tabs on the wild world of crypto!

CoinMarketcap

- This interface is busy, but it packs in a ton of extra data and features for when you get more advanced. I use this when I need to know a lot more about a specific Cryptocurrency.

Coingecko

- My favourite. I like its streamlined clean crypto dashboard layout and ease of use. It does not have the capability of CoinMarketCap but it does have a range of other excellent features that are just as good.

Crypto Helpful Apps

I have included these two apps with specific value but over time you will find more that works for you. Let me know if you want a bigger list of apps. Please find training videos on each application so you know how to use them.

| Dextools: https://info.dextools.io/ | Trading View: https://www.tradingview.com/ |

| DEXTools: Real-time DEX analytics, trading tools, and new pair alerts. I use it to check the quality of new coins. It’s a busy screen but you will work it out. | TradingView: Powerful charting platform for crypto, stocks, and more. It’s a bit more advanced but nothing you can handle. |

Crypto Exchanges Explained: CEXs vs DEXs

A cryptocurrency exchange is like a marketplace where you can buy and sell cryptocurrencies using traditional money (like USD) or other digital assets. They’re convenient for beginners, but it’s important to understand how they work.

Centralized vs Decentralized: Crypto Exchange Differences

In short, there are two main exchange types: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). CEX’s are easier to use but may have security risks because they hold your money which you deposit to them while making transactions. They are single entity companies and if they are regulated then they must follow specific rules in the counties they operate in. DEX’s offers more control. The DEX is simply a tool that you plug your wallet into and then make transactions etc. They don’t hold your crypto, but you must sign in, attach your wallet details, and allow transactions.

It sounds hard but it’s not that bad once you get used to them. It’s just a matter of getting used to them. You can plug them into hot or cold wallets and when I say plug it’s not like a wired thing. It’s simply creating a computer login access between your wallet (hot or cold) and the exchange for that transaction. Then you disconnect again. It can be more complex than that if you are working on decentralised finance tools but that is it in a nutshell. It’s also not a perfect world. Some DEXs can allow you to connect to things you should not, because they are scams. So only access trustworthy sites (use the CoineGcko or CoinMarketCap apps and websites to help) and this is a disadvantage they have compared to a CEX who tries to manage the safety aspect a bit better especially when you are just starting out.

Understand CEXs vs DEXs for Buying Crypto

Understand CEXs vs DEXs for Buying Crypto

The world of crypto exchanges can be a bit of a jungle. Should you go with the familiar vibes of a centralized exchange (CEX), or venture into the brave new world of decentralized exchanges (DEXs)? The best choice depends on a few key factors:

Factors to Consider

- Reputation is King (or Queen):

- CEX: Check online reviews, history of security breaches, and how long they’ve been around. Stick with reputable players!

- DEX: Research the team and technology behind it. Smart contracts can be audited – a good sign of transparency.

- Fees: The Devil’s in the Details:

- CEX: Often have clear fee structures, but can add up – withdrawal fees, trading fees, etc.

- DEX: Fees are usually based on the network (like Ethereum), which can fluctuate wildly depending on congestion.

- Security: Is Your Crypto Fort Knox?

- CEX: Your crypto is entrusted to the exchange. Hacks happen, so a solid track record is a must.

- DEX: You maintain control of your funds in your own wallet, which lowers risk. However, you’re responsible for keeping your wallet secure.

- Coin Variety: More Choices or Niches?

- CEX: Often lists a vast range of cryptocurrencies, sometimes even those smaller, riskier ones.

- DEX: Coin selection depends on the platform and can be more limited.

- Ease of Use: Click and Done or DIY?

- CEX: Built for usability, like online stock trading platforms.

- DEX: Require some crypto knowledge – wallets, connecting to platforms, etc.

- The Law is the Law

Always check your local regulations. Some CEXs may be restricted in certain regions due to licensing, while DEXs often function in a legal grey area.

So, which to choose?

- Beginners: CEXs might be easier to start with due to their user-friendly approach.

- Security-conscious: If you genuinely believe in “not your keys, not your coins,” DEXs offer more control.

- Explorers: DEXs might offer access to early projects and unique tokens.

Remember: It doesn’t have to be one or the other! Many experienced traders use both, depending on their needs in the moment.

Explore Regulated Crypto Exchanges (CEXs)

Tier 1: Regulated Crypto Exchanges

What they are: These exchanges generally operate in jurisdictions with stricter financial regulations. They often require more extensive verification (KYC) processes but offer enhanced security and consumer protection.

Pros: Generally safer and more trustworthy, especially for substantial amounts of crypto. Please do not trust any CEX with your Crypto as you should always learn to self-custody your crypto.

Cons: Might have higher fees and limited coin selection.

Popular choices for both beginners and professionals:

Uphold: (https://uphold.com/) Easy-to-use interface that supports various assets. Available as an app.

Kraken: (https://www.kraken.com/) Well-established, offers margin trading and advanced features. Available as an app.

Gemini: (https://www.gemini.com/) Highly regulated, focuses on security and compliance. Available as an app.

Crypto.com: (https://Crypto.com/) Wide range of cryptos, staking, DeFi features, NFT marketplace. It has a semi-crypto-native visa credit card option that is unique. The website is available as an app.

Coinbase: (https://www.coinbase.com)For normies. Excessively big, regulated exchanges in the USA. The slowest to list fresh new crypto and their website crashes. Don’t use this unless you have to. Only listed due to the volume of users.

Binance: (https://www.binance.com/) It’s going through a few regulatory troubles with the USA. I have used them a lot historically and found them to be reliable and easy to use with a good fee structure. I highly recommend them but be mindful of which regulatory market you are in and which web address you need to use.

Tier 2: Unregulated Crypto Exchanges

What they are: These exchanges often operate in locations with less stringent regulations. They can offer faster sign-up and wider coin selection but come with higher risks. They often offer much lower trading fees but pick your options wisely.

Security first: Prioritize secure storage of your crypto in self-custody. Consider using a hardware wallet for larger holdings. Titansreserve.com encourages you to find the one that suits your needs best. There are many Tier 2 Exchanges to choose from. These are only a few of them that I use regularly as I like the newer crypto which is rare on the Teir one exchanges.

Pros: More coins, potentially lower fees, quicker sign-up.

Cons: Less secure, funds might not be protected in case of hacks. Do extensive research before using it!

Popular choices: Use caution as they are theoretically the second-tier exchanges. I honestly use both and have had great results and experienced excellent service! That may change as we near the end of the crypto bull run and exchanges get drained of liquidity, so please be careful.

MEXC Global:

- A large variety of cryptocurrencies. Available as an app on iPhone ([invalid URL removed]) and Android. I use this exchange all the time and it is incredibly popular with crypto enthusiasts outside of the USA.

CoinEx:

- Supports a wide range of altcoins. Available as an app on iPhone and Android (https://play.google.com/store/apps/details?id=com.coinex.trade.play).

- In one case I thought I had lost some crypto through a hack on the CoinEX exchange and Coinex kept me in the loop with what had happened and recovered my crypto for me. Not many exchanges will go to that extreme to help their small clients, so that’s why I highly rate them as having exceptional service!

Dive into Decentralized Crypto Exchanges

DEX 101: Understanding Decentralized Crypto Exchanges

Here’s a breakdown of how Decentralized Exchanges (DEXs) work with your crypto holdings.

Imagine a peer-to-peer marketplace for crypto.

No central authority holds your funds.

You connect your crypto wallet (like MetaMask) to the DEX.

When you want to buy or sell crypto, you directly connect your wallet to the DEX.

The DEX matches your order with another user on the platform.

Your crypto goes directly from your wallet to the other user’s wallet, and vice versa.

Pros:

Security: You maintain control of your crypto in your wallet.

Privacy: No need to create an account or share personal information with the DEX.

Transparency: Transactions are often viewable publicly on the blockchain.

Cons:

Complexity: Requires understanding of how crypto wallets work.

Limited Liquidity: May be harder to find buyers/sellers for certain coins compared to CEXs.

Slower Transactions: Can take longer to complete trades compared to CEXs.

Best Decentralized Crypto Exchanges (DEXs) Across Blockchains

These will change over time but for now, these are just a few popular ones to consider on just a few of the many blockchains out there. Some DEXs are multichain and can span across Blockchains as the name would suggest. Some do it better than others. Don’t get into wrapped coins unless you know what you’re doing as that is a whole new topic to chat about.

- Uniswap: A giant in the DEX space, primarily focused on the Ethereum network. Known for its vast liquidity and wide selection of ERC-20 tokens.

- PancakeSwap: The most popular DEX on the Binance Smart Chain (BSC). Offers a similar interface to Uniswap with a range of BEP-20 tokens, staking, and other features.

- Curve Finance: Specializes in stablecoin swaps (ex: USDC and DAI). Its design makes it highly efficient for swapping assets with minimal price slippage.

- SushiSwap: A popular Ethereum-based DEX that also offers cross-chain compatibility. Features token swaps, yield farming, and various earning opportunities.

- Raydium: A leading DEX on the Solana network offering fast and low-cost transactions, and access to Solana-based tokens and liquidity pools.

- Minswap: A decentralized exchange on the Cardano network, still fairly new but gaining traction. Features token swaps, and liquidity pools, and is closely aligned with the Cardano ecosystem.

- Trader Joe: One of the most popular DEXs on the Avalanche network. Offers token swaps, yield farming, and access to the Avalanche ecosystem of tokens.

Spotting Crypto Scams: Beginners Guide on How to Avoid Crypto Scams by their telltale Red Flags

Red Flags – Scammer Alert:

- Sounds Too Good to Be True: If it promises guaranteed returns or absurdly high yields, run the other way. Crypto is volatile, and no one can predict the future.

- Pressure Tactics: Urgency is a scammer’s best friend. Anyone demanding you send crypto right now or miss out on something is likely a bad actor.

- Sketchy Sources: DMs out of the blue, websites with typos and weird URLs… Trust your gut! If something feels off, it probably is.

Remember: Crypto is still a young space, and scams are all around you. Educate yourself, stick with reliable sources, and never invest money you can’t afford to lose.

This is not the end but the beginning of your journey. I can keep writing in this blog but maybe I will do that in another blog post as this one has gone on for far too long already.

Keep safe in your crypto journey and I am always here if you need help. Just reach out with an email if you need to. If you want one-to-one coaching, then you can reach me through email, and we can sort something out.

FAQ:

What is an ACH transfer?

An ACH transfer, also known as an ACH payment,

This is an electronic money movement between banks and credit unions facilitated by the Automated Clearing House (ACH) network. It’s a widely used system for various payment processes.

Here’s a breakdown of ACH transfers:

- Function: Transfers funds electronically between bank accounts.

- Network: Relies on the Automated Clearing House Network (ACH) for processing.

- Uses:

- Direct deposit of salary or benefits.

- Online bill payments.

- Person-to-person transfers (through apps like Venmo or Zelle).

- Tax refunds or payments.

- Business-to-business payments.

There are two main types of ACH transfers:

- ACH Credits: Money is “pushed” from one account to another (e.g., direct deposit of your paycheck).

- ACH Debits: Money is “pulled” from an account, often used for recurring payments (e.g., automatic bill payments).

Compared to wire transfers, ACH transfers are generally:

- Slower: Can take 1-3 business days to settle.

- Less expensive: Often free or have lower fees than wire transfers.

Thinking of using an ACH transfer? Here are some additional things to consider:

- There may be limits on the amount of money you can transfer at once.

- Be sure you have the correct routing number and account number for the recipient.